This quote from Brian Armstrong holds the clue to an underappreciated threat to Coinbase.

…many of the companies we think of as cryptocurrency exchanges were actually brokerages, exchanges, custodians, and clearing houses bundled into one….I think we’ll see the cryptocurrency market structure evolve to more closely resemble the traditional financial world, with these functions being separated out…

Brian Armstrong

TL;DR

- Brokerages are an inevitable evolution of crypto-finance, abstracting investors from exchanges.

- This is the new battleground in crypto and the winner holds the key to serving users with a full suite of financial products.

- Coinbase faces a classic innovator’s dilemma. Their exchange business is a cash cow today, but a liability in the battle to own the brokerage layer and winning the next phase in crypto.

The Opportunity

The $100B opportunity over the next decade is to own the brokerage layer in crypto.

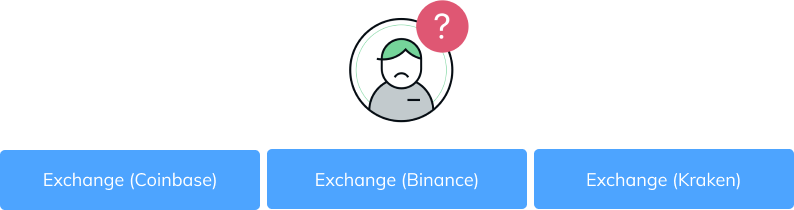

Let’s assume Brian is right and crypto-brokerages emerge. The key to appreciating the importance of this trend is that brokerages, not exchanges, own the end user relationship. And owning that relationship is critical.

That relationship is the key to cross-selling banking, savings, borrowing and investing products, crypto or otherwise. Winners in finance offset high CAC by serving all your finance needs. The brokerage has the customer touch points to understand their needs and market other products.

This is why every fintech company follows a land and expand strategy and why Coinbase is expanding from their core exchange business.

The Dilemma

Coinbase’s strength today, their exchange, may be severely impacted in the battle to own the brokerage layer.

Brokerages execute customer orders at the best price, thus they operate across exchanges tied to no single source of liquidity. A healthy market for crypto-brokerage products would deteriorate Coinbase’s pricing power and volume.

Today all Coinbase retail orders are funneled directly to their exchange. Competing with other high-quality brokerage products would require Coinbase to provide best execution for customers, distributing their order flow across competing exchanges.

This begs the question, will they sacrifice short term revenue for the longer term prize. It’s easy to say yes in theory but hard to do in practice, even for a private company.

Consider that they just raised trading fees! It’s less expensive for them to offer this service over time, but they chose to offset declining volumes by raising fees. Does that sounds like a company ready to sacrifice short term revenue?

Brokerages make the market more efficient in general which reduces cost. So even if Coinbase doesn’t compete directly with other brokerages, they will feel their emergence via reduced margin.

Are you thinking that Coinbase is the 100 lb. gorilla of crypto and will naturally dominate every layer in the stack? Consider though that only ~50M people hold crypto today. A rounding error. The billions of new users will choose their onboarding path via crypto-native brokerages and banks, not directly with exchanges. So Coinbase’s dominance is far from certain.

Hope you enjoyed the post, follow me here or twitter!