Soon you’re more likely to deposit paychecks, get loans and credit cards from Google than Chase.

Finance is shifting from the banks of the gilded age to the design thinking and A/B testing of the apps on your phone and the web.

This massive shift is being driven by changing customer expectations, the emergence of enabling technologies and the massive reach of consumer platforms.

TL;DR

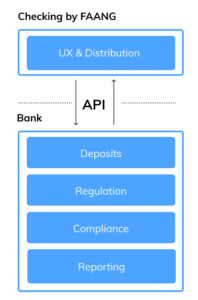

- API’s are making financial products, like checking and lending, a UX and distribution problem, instead of a regulatory & compliance one.

- High-engagement consumer brands like Google or Amazon can leverage these API’s and changing consumer sentiment to offer financial products directly, cutting out middlemen.

- To maintain their positions, banks are in a race to build viral consumer experiences before the consumer tech giants can scale financial products. Guess who’ll win?

Finance, by FAANG

We’re already seeing the first entries with Google checking accounts and the Apple credit card.

It’s easy to understand the attraction to financial services beyond the scale of the market size. Financial products capture huge amounts of consumer data. That data serves as the backbone of better products and UX to tech companies highly adept at leveraging personal information for profit.

So, why now?  Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition.

Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition.

APIs digitize the financial plumbing so that FAANGs can focus on what they are great at, habit forming consumer experiences.

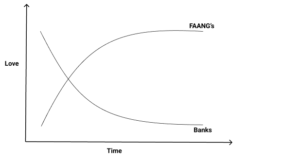

The timing is also right. 71% of millennials would rather visit the dentist than their bank. At the same time, they are increasingly trusting FAANGs with more and more of their needs.

The timing is also right. 71% of millennials would rather visit the dentist than their bank. At the same time, they are increasingly trusting FAANGs with more and more of their needs.

Who Is In Control?

If banks control the underlying APIs, then it may seem like they are still in control. Which layer of the stack matters, and who’s making the money?

Banks aren’t going away, they serve a valuable purpose and will continue to make money. For now.

The last mile to the user will be served by FAANGs. Once they’ve aggregated the user demand, they will have power over the supply side (banks). Including the option of building their own banks to serve this demand.

Ben Thompson Aggregation Theory

While banks aren’t going anywhere, they are facing a future where they are cutoff from the end consumer. Ask media publishers how that’s gone for them over the last 20 years!

Banks are in a race to build high engagement consumer experiences before the FAANGs can deliver finance products to their massive and engaged userbases.

My money is on the tech giants.

Fintech 3.0

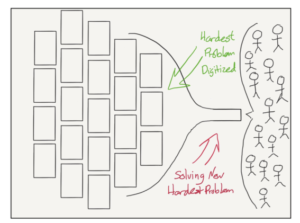

This trend has huge implications for Fintech entrepreneurs. The biggest opportunities today are in the API’s that help brands deliver financial products quickly.

The first wave of Fintech (Paypal, E-Loan…) brought traditional financial services online and created self-serve, lower cost options. It was driven by a small set of users comfortable online and happy to find a good deal.

The second wave (SoFi, RobinHood…) paired alternative data sources with novel customer acquisition tactics to deliver services more efficiently. Fees are compressing and the users were digital natives.

The third wave will see the emergence and growth of API-driven Fintech infrastructure (Alpaca, Mercury…). They’ll be integrated by consumer brands to bring finance products directly to users, removing middlemen. Fees will approach zero and the consumer experience will feel more like Instagram than Chase. The users are not only digital and mobile native, but have little to no loyalty to existing financial brands.

For example, Alpaca offers anybody an API enabling to offer users stock trading. They handle regulations and the product can focus on UX and user acquisition.

Imagine every Google Finance page connected to your Google bank and brokerage account. Google could offer one-click trading and deposits, at zero fees, subsidized by revenue earned elsewhere. They could analyze the user’s finance data to offer other finance products (robo-advisor, loans, credit cards…), but also mine the data to improve other areas of their business.

They’d have such a rich view of the user’s finance history, they could sell incredibly targeted (i.e. high cost) ad space to providers of those products interested in reaching a very specific audience. They would also be able to attribute a search ad display all the way to the purchase of an item, even if purchased offline. That’s an incredibly value feedback loop for ad buyers.

Hope you enjoyed the post, feel free to reach out with questions & comments. You can reach me on twitter!

One thought on “Alexa, Can I Get a Loan?”

Comments are closed.