Early stage financing has evolved radically, everything from the amount of capital available to the types of funds and their return targets.

It’s critical that founders think about company/investor fit as they choose financing partners, particularly in the earliest stages.

Why?

Choosing for company/investor fit enable founders to authentically build the company they envision. It also avoids misalignment between founders and investors along the way as critical decisions are made.

Early Stage Capital Explosion

A few trends have converged, creating an explosion of both capital (3x as more in the last 10 years) and types of funds managing that capital focused on early stage.

- Yield Chasing – We’ve lived in a zero and negative interest rate environment for years now. 15+ countries offer negative returns on their sovereign debt. Capital managers are chasing yield in riskier sectors and stages.

- Software Ate the World – The importance of tech in our lives grow and their market cap dominance does also. Early stage tech is a good place to chase yield.

- Software is Cheaper to Build – AWS has made software 10x cheaper to build, meaning companies can do more with less capital.

Funding Landscape

The amount of capital focused on the seed stage from traditional venture capitalists has exploded, ~500 firms at last count. These are “traditional” in that their goal is to return 3x+ of funds invested (net of fees) to deliver top decile results to their LPs.

The growth in number of firms and capital gives founders options of personalities and operating styles to choose from, if they believe their business has the potential to fit their return profile.

Let’s focus instead on the emerging class of alternative capital sources for early stage tech that offer founders other options.

- Shared Earnings – (Indie.vc, Earnest Capital) These firms invest provide between $75K to $1M to companies on a shared earnings model. This is a novel approach for software business that aligns the returns the fund targets (~6%) with revenue generated by the company over a given time period.

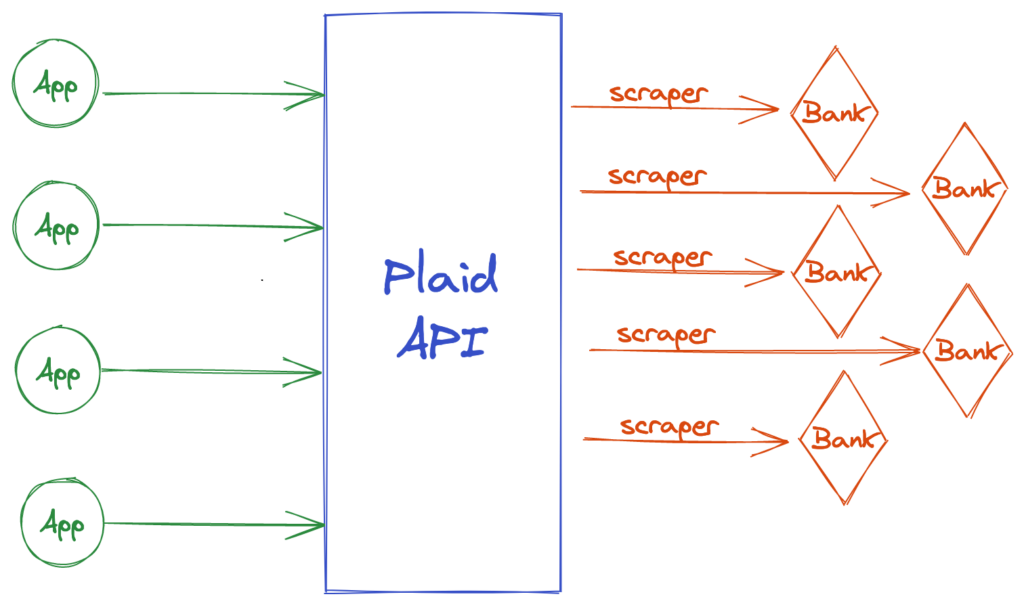

- Non-Dilutive Working/Growth Capital – (ClearBanc, Lighter Capital, Capital, RevUp) These firms offer capital to grow and run your business with fixed terms (~1%-20%), no equity warrants or conversions. These models are more efficient today via real-time data the company can provide the lender. For example, ClearBanc can inspect your ad spend and conversions to asses the health of your marketing spend to base a loan decision.

These alternative funding sources have vastly different return needs than traditional venture capital. They provide new, and in some cases more efficient path, for founders building businesses that fit the profile.

Why Company/Investor Fit Matters

Imagine you’re running a business that is doing $5M in ARR and growing steadily with healthy margins. You can either pocket the free cash flow or reinvest for growth. Odds are you’re probably happy.

Except…if you’ve taken early investment from a fund that needs you to hit $100M in revenue in the next 3 years to meet their return expectations. Oops, instant misalignment in the decisions to be made about how to grow the business.

Raise another round, build a risky new product line with 10x possibilities or incrementally grow your existing one? Easy decisions when the company and investor share the same expectations. Nightmares when they don’t.

Pick the investment source that aligns most closely with the business you plan to build. Then adjust on the fly because nobody’s business goes according to plan!