Heavily funded Neobanks market themselves as the future of finance – mobile-first and customer obsessed. We could all use less Wells Fargo in our lives after all. However, Neobanks (Chime, N26, etc…) are not the only threat that banks should be concerned about.

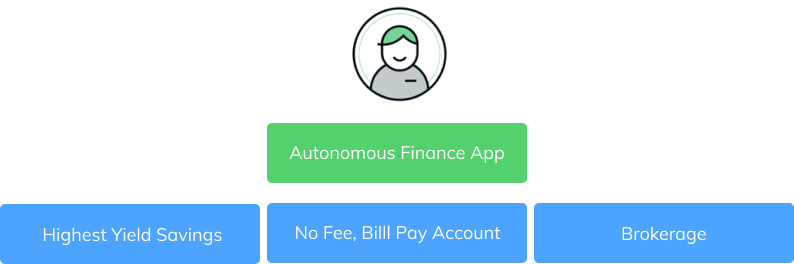

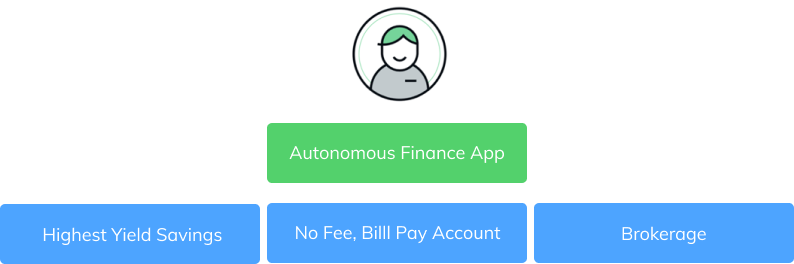

Less heavily funded and heralded are autonomous finance apps (Albert, Astra, Northstar, etc…). These apps manage assets where they already reside, spread across existing accounts.

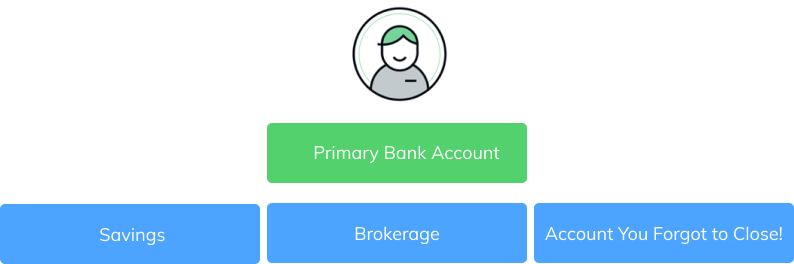

Personal finance manager apps pose a serious threat to banks by turning the deposit holding bank (Bank of America, Wells Fargo, etc…) into commodity services differentiated only by their yield or fees.

The app manages funds according to the user’s rules.

- Want to save $100 each month? The app takes $100 from your direct deposit account and moves it to a high-yield savings account.

- A new savings account is introduced that offers higher yield. Great, the app manages moving funds so you maximize earnings.

No single bank is motivated to offer features that work across accounts. They want all your deposits in their bank, not others. Their mission is to bundle all the finance products you need in one place and keep your business.

By removing the friction of managing funds across banks, these apps change the nature of the relationship between the user and their money. This is the threat to banks.

Gradually, the user’s attention and relationship shifts from their primary bank to this app that manages their assets. When they think about how to save, get a loan or deal with their finances they open the autonomous finance app first, not the bank’s app.

If the app manages the flow of funds across accounts, does the user care which company offers the underlying accounts? As long as it carries insurance, the criteria becomes solely the lowest fees or highest yield, not the bank brand. That’s dangerously close to accounts and the institutions that offer them becoming commodities.

Banks beware. These apps may look like toys today, but we’ve learned that the next big thing often starts out looking like a toy.