Regulation could help here…gulp.

Particularly in the US, our financial data should be more easily accessible and transportable. This would make it simpler for more applications to be built to give us views into our financial life (bank account, brokerage, etc…). That in turn would allow different segments of the population to be better served for their needs. Worried about overdrafts? Remittance fees? There’s an app for that.

Wait. Doesn’t Plaid make financial data easy for developers to access $5.3B different ways? And didn’t Mint begin this trend over a decade ago? Yes and yes.

Notice I said improve in the title though, not enable.

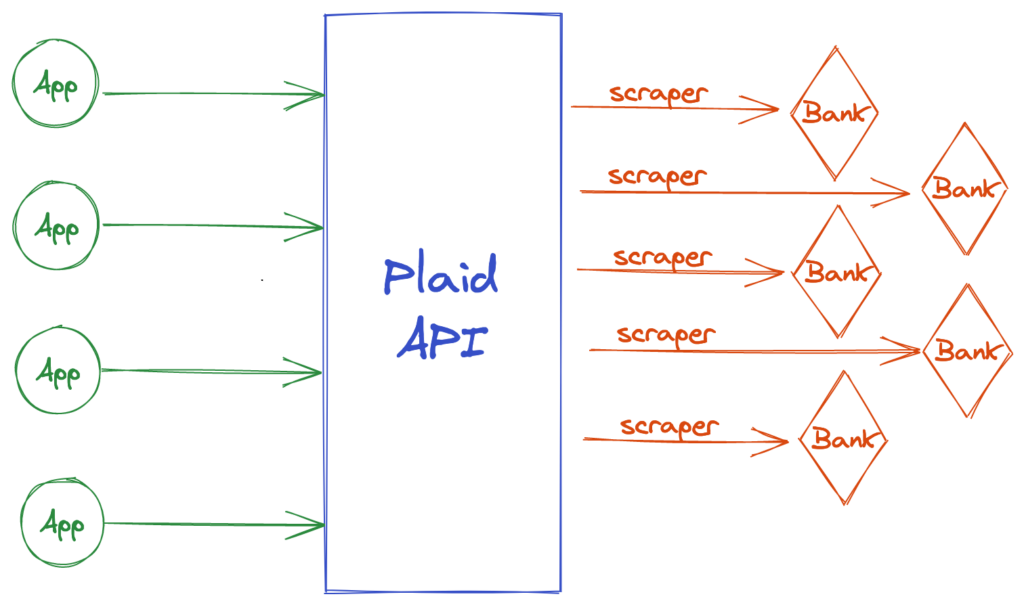

First a quick background on how Plaid, Yodlee, and others work today. Primarily they compile your financial data via screen scraping. They access your account using the credentials you provide and parse the interesting data (account balance, tx dates, etc…) to share through a formal API to an app developer. For the app developer it saves time and allows them to focus on their unique business value rather than plumbing.

To be clear, I’m not condemning screen scraping. I’ve used it in multiple companies to structure data that resides in unstructured formats on websites or PDFs.

It does have serious problems though. For one, it’s brittle. The underlying site changes often and when it does your scraper breaks. So access to some banks is constantly under repair and there is no way to know when. Also, it can break completely when the provider of the website wants to break your scraper. And they have multiple reasons to want to do this.

So what can be done? Why don’t banks adhere to a standard format of making data available? It is your data in the first place. Unfortunately, they have no motivation to do so. They prefer you live within their universe of products and not easily manage finances across banks or have simple access to products elsewhere that would compress their margins.

Europe offers a roadmap to solve this with their PSD2 initiative. Among others things, PSD2 requires banks to adhere to a standard API for data access. Unfortunately, there probably isn’t another way to make this happen among banks that aren’t motivated to do it on their own. More unfortunately, we probably won’t see a similar rule in the US.

This wouldn’t negate the value of Plaid and similar services (see Tink for proof). It would serve to make their APIs more robust and reliable. The winners would be end users benefiting from more ways to manage their financial health. And we should all want that outcome.