Banks wage an ongoing war to hold your money. You’ve seen the tactics — higher interest rates and free credit reports are the modern free toaster to open a new account and setup direct deposit.

You get those free toasters because:

- Banks earn money by holding your money.

- There’s inertia to deposited money. You’re too busy to move it around optimally, it generally stays where deposited. The bank that gets it first gets to keep making money from it.

In the perfect world, your money would flow from paychecks to where it’s needed at just the right moment. It would earn you the highest return in the right accounts for the right purpose, while ensuring your bills and payments are covered.

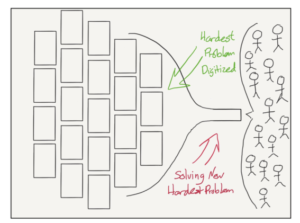

A new generation of apps are changing money management by automating personal finance. These apps will become the primary way people manage their money, owning the customer relationship and ultimately their deposits.

Autonomous Finance apps that improves financial health and save time are the new battleground in finance.

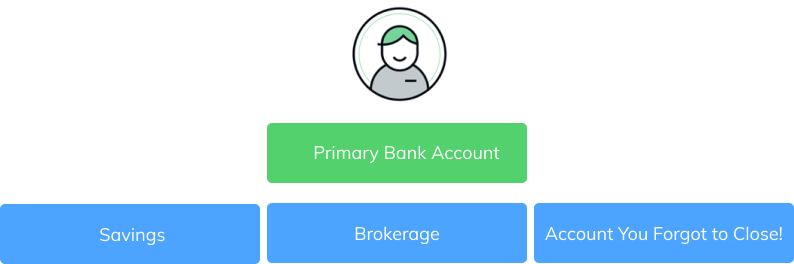

Personal Finance Today

Today, your finances probably look something like this.

Your income flows into a main account and perhaps you move some for savings and bills elsewhere. If you’re like most people, you probably don’t do that, just operating out of that one account.

Banks battle to be that primary account.

Maybe there are higher yielding accounts elsewhere? Maybe you should be moving set amounts every month for savings? Maybe you’ve exceeded the SIPC insurance limit and really should split money into separate accounts so you’re protected from a black swan? Maybe you’re forgetting to move funds some months and accruing overdraft fees?

People are busy and distracted. So maybe they do none of these things even though it’s in their best interest.

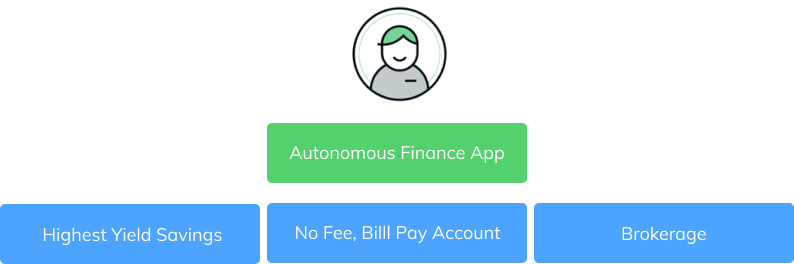

How Autonomous Finance Apps Change Things

Tomorrow, Autonomous Finance apps will be the primary way you manage your money.

The application manages the movement of funds according to rules you set or that it figures out based on your behavior.

- Need $1,000 in your checking account on the 5th of the month? No problem, the app will make it happen and ensure you don’t get hit with an overdraft fee.

- Want to put aside $100 each month for a large purchase? Done.

- A new savings account is introduced that offers higher yield? Easy, the app manages moving funds so you maximize earnings.

The key thing here is that your primary relationship is with the application. The accounts used become commodities that can be interchanged by you or the app itself. Accounts compete purely on their utility for the purpose they serve—interest rate, fees, etc…

Owning the customer will take more than getting them to open an account and setup direct deposit. The software eats the inertia of how accounts are used. Owning that software and providing the user the best experience is the new battleground.

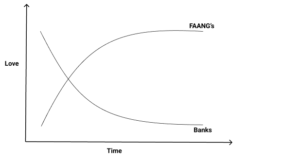

Who is best poised to create that software? Startups and FAANGs or the banks that most people like less than their dentist?

Autonomous Finance Apps Today

The universe of apps today is large and growing. Each approaching the problem uniquely for their target markets. Here’s a round up of just a few.

- Dave — Automated overdraft fee protection

- Stash & Acorns — Automated savings

- Max My Interest — Maximize yield and insurance protection

- Astra — Setup your own rules

Ultimately, only one or two of these businesses are likely to emerge as large, standalone players. We’ll all benefit from how they will rewire the competitive landscape by having more options to manage our money more easily and efficiently.

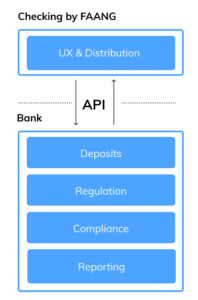

Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition.

Emerging Fintech API’s makes it easier to build products like checking and lending today. The API from a bank for deposits separates the regulatory burden (i.e. the historical barrier to entry) from the UX and customer acquisition. The timing is also right.

The timing is also right.